Why?

Professional Investors’ Memos, Sheets & Slides Offer Insight around a Base Case for an Investment’s Return

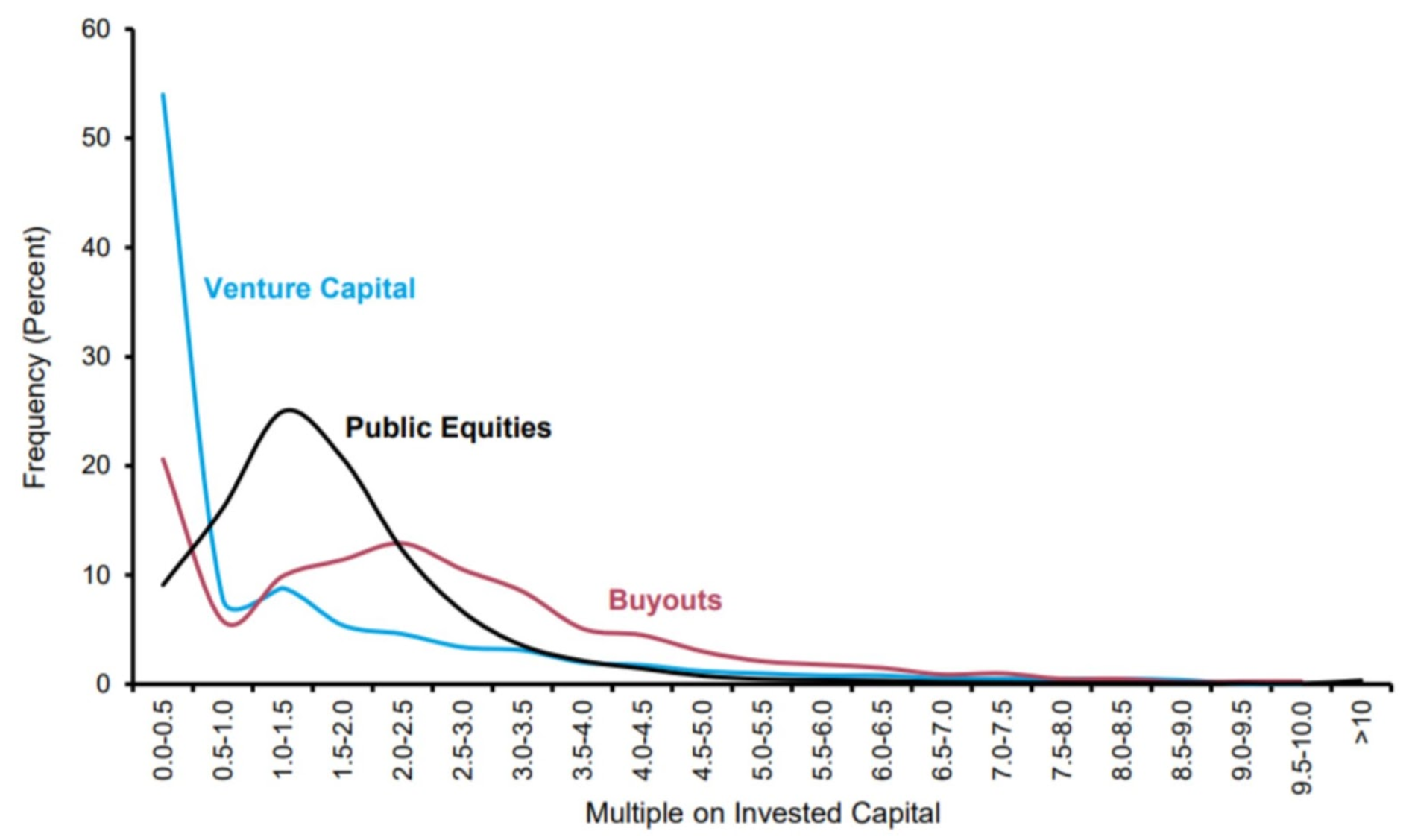

But the Frequency of Outlier Cases Drives Investors’ Portfolio Returns

How

Our Software Integrates Research Management & Scenario Modeling, Automating LLM Prompts to Help You Quickly Translate Your Research into Explicit Odds for Outlier Cases

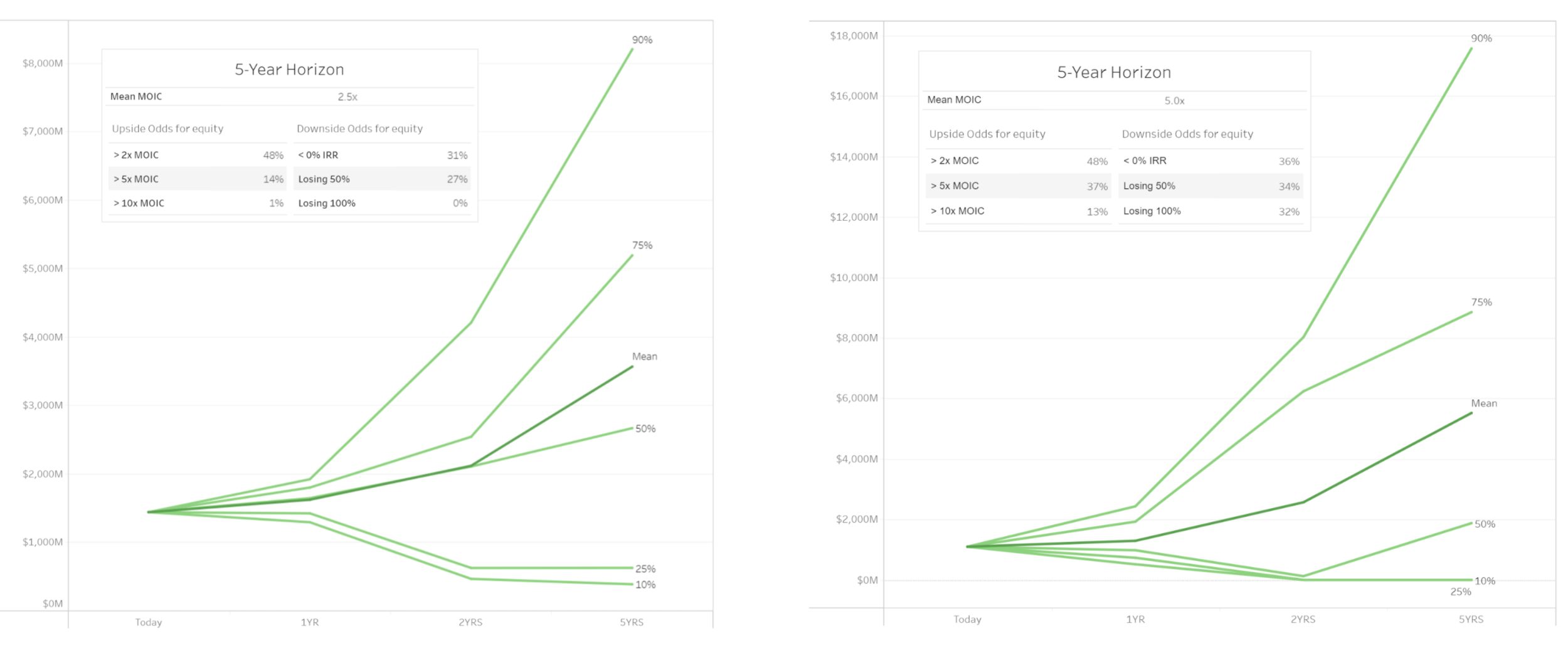

That Enables Concise & Consistent Comparison of Risk & Return Across Different Investments